How to Pay for Expensive Home Repairs

If there’s one thing that all homes have in common, it’s that at some point, they’ll need to be repaired. Some of these repairs will be minor and cheap to perform. But when a big fix is needed, things are bound to get costly.

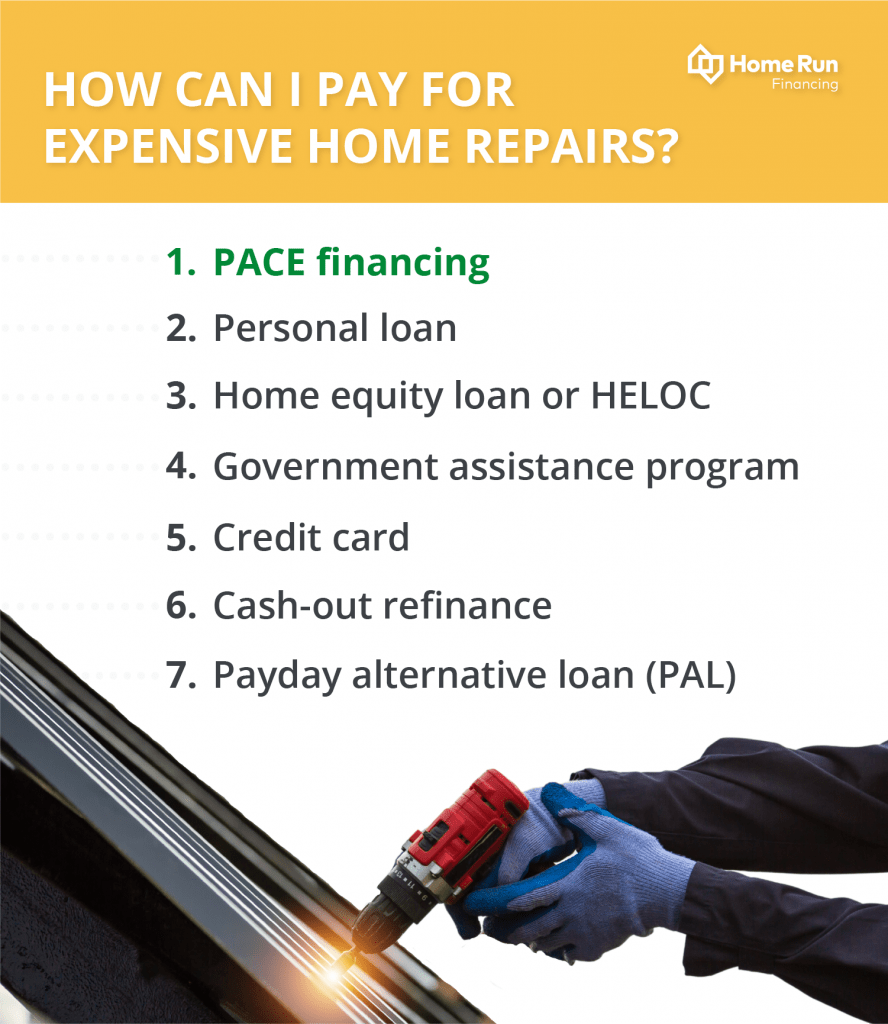

Funding expensive home repairs can be a challenge — especially when they’re emergencies. Luckily, there are several funding options that can help you afford home repairs when you need assistance.

What options do you have to pay for home repairs?

For most people, having ready cash or sufficient credit to pay for costly emergency home repairs isn’t easy. Consumer Affairs reports that the most common repairs In the United States involve plumbing. Nearly 28% of us needed a plumber in 2019. The No. 1 repair needed in Florida was air conditioning. And as every Southern homeowner knows, eventually your entire system will need replacing — a critical repair that can easily turn into a major expense.

But is your credit good enough to qualify for whole-system central heat and air financing if it happened today? If you’re like many Americans, you’re not sure how you would afford home repairs in an emergency, especially if you have bad credit. Many of us don’t have enough in savings, don’t have the right (or enough) insurance and don’t qualify for government grants.

Nevertheless, financing options are available. The right option for you will depend on your financial situation, such as your credit score and the amount of home equity you have.

1. Take out an unsecured personal loan

If your credit is good, you may qualify for a low-interest, unsecured personal loan, and the turnaround time is usually quick. Some lenders promise instant approval and next-day funding, while more traditional sources may take a week or two.

Banks, credit unions and many online lenders offer personal loans. To get an unsecured personal loan, you do not have to put up collateral, like your house or car. Lenders approve these loans based on your credit worthiness, evaluating your credit history and financial situation.

Before you take out a personal loan, be sure to read the fine print. Typically, traditional private loans offer lower interest than credit cards to qualified applicants; however, borrowers with lower credit scores may be charged a high APR. The rates can range from very low for excellent credit up to 36% for borrowers with a questionable credit history.

The advantage to this type of funding is closed-ended repayment terms with an affordable, fixed payment each month. You’ll know what to expect and when the loan will be paid off. Since you may be able to borrow up to $40,000 when paying for home repairs, it’s an especially good option if you have an expensive repair coupled with structural damage or renovation costs.

2. Apply for a home equity loan or HELOC

When you take out a home equity loan, you borrow a sum of money based on the equity in your residential property. Equity is the difference between the market value of your home and what you still owe.

In comparison, here’s how to pay for home repairs with a HELOC:

A home equity line of credit (HELOC) is a loan vehicle that allows you to use the equity in your home as an ongoing funding source. Instead of a one-time loan, it’s an open account where you can draw money any time you need it.

HELOCs have much lower interest rates than most credit cards, but they can take weeks to get approval. On the upside, if you have one already in place, you won’t need to jump through any hoops to borrow what you need. You simply draw the money you need and pay it back over time.

For either type of loan, the amount you can borrow is limited by how much equity you have built up over time. If you purchased your house recently, loans based on equity may not be viable options.

You should be aware that home equity loans and HELOCs are secured loans, using your home as collateral. If you cannot repay the loan, the lender could foreclose. To ease the sting of having to make payments, you may be able to take a tax deduction for interest with either type.

3. Pay for home repairs through PACE financing

In some states, you may have the alternate option of using Property Assessed Clean Energy (PACE) financing. PACE financing is a program that allows you to borrow up to 15% of the value of your home.

Here’s how PACE financing works:

If you need a new roof but can’t afford it, for example, you may qualify for 100% PACE financing, which means you don’t have to put money down upfront. You can repay the loan over a term length that makes the payments affordable for you — up to 30 years — and your first payment may not be due for up to 18 months. Interest is far lower than loans or credit cards, and there’s no penalty for paying your loan off faster than expected.

Typical eligibility factors for a PACE loan:

- Low debt-to-income ratio

- Minimum of 10% equity in your home

- Up-to-date property taxes and mortgage payments

You can qualify for PACE even with bad credit, as long as you meet state requirements.

In comparison to other types of loans, PACE financing offers long terms, low payments and low interest, making it a very affordable option if your budget is tight. The loan amount is added to your property tax payments. However, it’s important to know that your home could go into foreclosure if you can’t pay it back. All things considered, though, PACE financing is the best way to finance home improvements for most people.

To find out if you’re eligible, contact Home Run Financing today.

4. Refinance with a government assistance program

You may qualify for a government assistance program designed to help homeowners keep up with maintenance, major home repairs and emergency expenses. Here’s a quick overview of how to pay for home repairs through government refinancing programs:

- FHA refinancing: The Federal Housing Administration (FHA) offers 203(k) and Limited 203(k) refinancing loans. Essentially, you refinance your house and roll the cost of the repairs into the amount you want to finance.

When interest rates are lower than when you purchased your house, this is a good option. Although you will likely have to pay closing and origination fees upfront, you could wind up paying lower monthly payments and save money on interest. If interest rates are the same or higher, and you have little home equity, this is not a good option.

- HUD-insured loans: The Department of Housing and Urban Development (HUD) has a program designed to help homeowners with little home equity finance major repairs, purchase necessary appliances and invest in home improvements. The program does have some limitations as to how the money can be used, though. For instance, you can’t finance a pool or build a deck with the money.

It’s important to note that HUD only insures Title I Property Improvement loans. You need to go through a traditional lender to get one.

5. Pay for home repairs with a credit card

Homeowners with great credit have plenty of options for paying for home repairs, including putting repairs on a low-interest credit card, or even opening a new credit card with a zero-interest introductory rate. If you have a high credit score and can afford to make big payments, this is a fast and easy solution.

If your credit isn’t perfect or you’d have trouble making big payments, running up your credit card debt could be expensive. Credit card interest for people with lower credit scores is astronomical. For example, let’s say your credit is just under 700 and you take out a credit card with 23% interest to pay for a $5,000 emergency home repair. If you made a minimum payment of $150 a month, it would take 4.5 years to pay it back, and you’d pay the $5,000 plus a whopping $3,048 in interest. And these days, 23% is a low rate for people with poor credit scores — yours could be much higher. High-interest credit cards can land you in real financial trouble.

6. Use a cash-out refinance for emergency home repairs

If you have home equity, either from paying your mortgage down or from a rise in your home’s value, cash-out refinance is an option. Cash-out refinance is not a secondary mortgage. You replace your existing home loan with a new one. With this type of loan, you can refinance for up to 90% of your home equity.

If you have a lot of equity in your home and interest rates are lower than your original mortgage, this could be a good option. There are no restrictions and you can use the money for unexpected home repairs, renovation projects or expenses unrelated to your home, like extra money to pay for your child’s college education or go on vacation.

Paying for home repairs with a cash-out refinance may not be a sound financial decision in the long run. Signing a new mortgage means a new loan period. Depending on your terms, you could be looking at extending payments for decades, paying a great deal more in interest and draining the equity from your home.

7. Take out a payday alternative loan (PAL)

High-cost payday loans are a bad idea in most cases. The interest rates are high and repayment times are short with this type of financing.

A payday alternative loan (PAL) sounds similar, but it is quite different. PALs are loans offered by federal credit unions to their members. Loan amounts are relatively small, from $200 to $1,000, with payback terms from one to six months. While it’s not the best answer for how to pay for expensive home repairs, if you’re a member of a credit union and need to borrow a small amount to pay a homeowner’s insurance deductible, a PAL might be a good option to consider.

What to do when you can’t afford home repairs

For average homeowners, paying for home repairs can be a serious financial burden. When an emergency happens, knowing how to pay for expensive home repairs can help you make smart decisions to cover the cost without damaging your long-term financial goals.

Your options are far more limited if your credit is bad and you need money for an emergency home repair in a hurry. And even with good credit, some options are clearly better than others.

Home Run Financing helps you stay on track with no money upfront, low interest rates and payments you can afford. When the repairs are done, you’ll still have the equity in your home — like money in the bank — and your credit rating won’t be compromised.

Check to see if you live in one of the Home Run Financing service areas, and learn more about how to pay for home repairs when disaster strikes, with Home Run Financing.